How to Switch Car Insurance in Ontario

By Daniel Schoester | Published on 27 Mar 2023

You can switch your car insurance at any time in Ontario. However, there are better times to change your insurance. This is because many companies charge fees for policyholders who switch mid-term. In addition, not every insurance policy is created equal. Many Canadians focus on reducing their monthly payment at the expense of coverage limits, deductibles, and customer service.

In theory, your monthly payments (premiums) should decrease after proving you’re a safe driver. In reality, multiple external factors could increase your rates. For example, imagine your existing company experienced increased claims from your neighbourhood. They would need to raise rates for all their customers in that area. However, another company may offer lower premiums instead.

The rule of thumb is that you should begin comparing car insurance quotes if your rate increases by 10%. Canadians receive about three new quotes on average. However, there are various tricks and traps to be aware of when changing policies. This article will walk you through everything you need to know to reduce fees and ensure you have the best coverage for your needs.

Pros and Cons of Switching Car Insurance

| Pros | Cons |

|---|---|

| • Lower rates • Better coverage • Improved customer service • New discounts | • Loss of loyalty discounts • Cancellation fees • Temporary coverage gaps • Adjustment period |

Pros of Switching

- Lower rates: One of the biggest reasons people switch car insurance is to save money. By shopping around and comparing rates from different insurers, you may find a significantly cheaper policy than your current one.

- Better coverage: Depending on your current policy, you may find an insurer that offers better coverage, including things like roadside assistance, rental car coverage, or higher limits on liability coverage.

- Improved customer service: If you’ve had a bad experience with your current insurer’s customer service, switching to a different company may give you access to better support and more responsive agents.

- New discounts: Some insurance companies offer discounts for things like good driving habits, having multiple policies with them (like home and auto insurance), or being a member of specific organizations. Switching to a new insurer may give you access to these discounts, which could save you money.

Cons of Switching

- Loss of loyalty discounts: If you’ve been with your current insurer for a long time, you may receive a loyalty discount on your policy. Switching to a new insurer could mean losing that discount and paying more overall.

- Cancellation fees: Depending on your current policy, you may face costs for cancelling your insurance early. These fees vary widely, so checking with your current insurer before making any decisions is essential.

- Temporary coverage gaps: When you switch insurers, there may be a brief period when you don’t have coverage. If you get into an accident during this time, you may be responsible for paying for damages out of pocket.

- Adjustment period: Depending on the insurer you switch to, you may need time to adjust to new policies, procedures, and customer service representatives. This can be frustrating if you’re used to dealing with a particular company and its representatives.

How to Change Your Car Insurance in Ontario

As stated, you can switch your Ontario car insurance at any time. However, there are specific nuances to changing after particular events. This section begins by explaining the general step-by-step process of switching. Furthermore, the following subsections discuss additional considerations when switching at typical times.

- Step One: Research different companies and compare policies. Look for the best value regarding coverage, customer service, and pricing. The three best ways to find new insurance are talking with a broker, applying online, or directly speaking with an agent.

- Step Two: Collect current proof of insurance (pink slip).

- Step Three: Contact your current provider to cancel your policy. Be sure to ask about your refund for any pre-paid premiums and how long it will take for the cancellation to go into effect.

- Step Four: Purchase a new policy with your chosen provider. Follow their instructions for making the payment and providing proof of insurance to the applicable authorities.

- Step Five: Submit any required paperwork regarding your change in coverage to ServiceOntario.

Annual Car Insurance Renewal

The best time to switch your car insurance is during the annual renewal. This will avoid any fees or penalties associated with changing mid-term. Ensure to begin the process a few weeks before the renewal date to prevent coverage gaps.

Switching Insurance Mid Policy

If you switch your car insurance mid-term, there may be a cancellation fee or other charges. Make sure to check with your current insurer before switching. There are two ways an insurance company may handle your cancellation fees; short rate or pro rata. Each one is explained in more detail further into the article.

After an Accident

Switching companies after your first accident will likely increase your rates. This is because many companies offer one-time accident forgiveness to their existing clients. This means your rates will stay the same with your current company.

The company that covered you during the accident will also process your claim. You can’t immediately switch companies and have the new one cover you. Always disclose the open claim to your new company when receiving quotes.

Moving to Another Province

Moving to a different province means you must switch car insurance. Inform your current insurer of the move and obtain proof of your policy cancellation. You will also need to apply for a new one in the province you are now living in. Be aware that some provinces have car insurance managed through the local government. These provinces include British Columbia, Manitoba, and Saskatchewan.

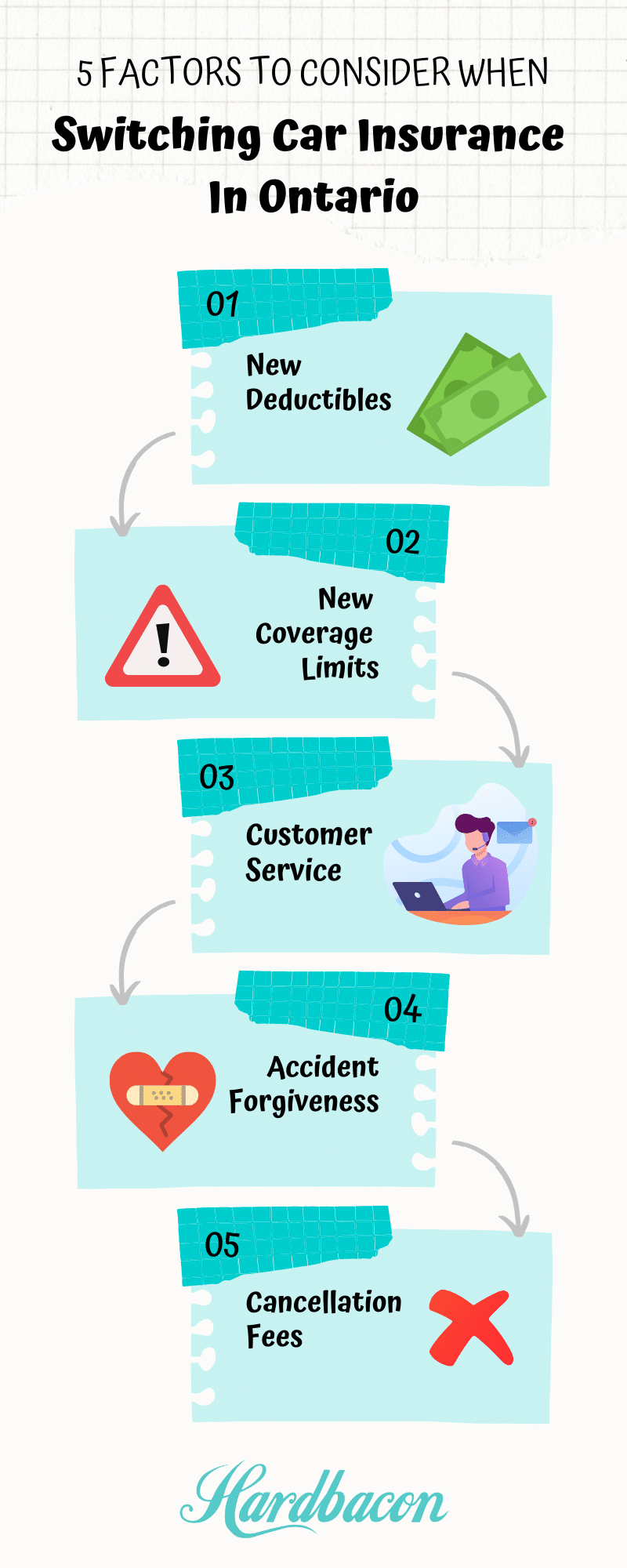

The Five Factors to Consider When Switching Your Car Insurance

Almost everyone focuses on the monthly payment when comparing car insurance companies. However, be aware because many factors determine an excellent insurance policy. For example, is a lower monthly payment worth it if you’ll have to pay twice as much when an accident happens? What about staying on hold for hours to connect with an agent? This section will empower you about all the factors to consider when evaluating your insurance options.

1. Deductible

The deductible is how much you must pay out of pocket when filing a claim. This is typically $500 or $1,000, meaning you’ll have to pay this amount before receiving compensation from your insurance company. Increasing your deductible will almost always reduce your monthly payment. Remember this because another insurance company may tempt you with lower monthly payments but higher deductibles.

2. Coverage Limits

Another trick to be aware of is monitoring coverage limits. A lower coverage limit will reduce your monthly payment because you’re taking on more risk. However, this could cost you if an accident comes out of pocket because it exceeds the coverage limit. Always monitor the coverage limit of your policies when switching insurance companies. Your new company may offer lower monthly payments but have negligible coverage.

3. Customer Service

Remember to consider the importance of excellent customer service when selecting an insurance company. When you file a claim or have questions, you want to speak with a helpful and knowledgeable representative. Therefore, consider the company’s reputation for customer service, including their response time and availability. Look for reviews or ask friends and family for recommendations to ensure a pleasant experience when dealing with your insurance company.

4. Accident Forgiveness

This applies to you if you’ve had an accident with your existing company. Many insurance companies offer accident forgiveness programs that protect you from premium increases following your first at-fault accident. If this happens to you, a new insurance company may drastically increase your monthly payment because they won’t forgive your accident.

Sometimes, a new company may charge two or three times as much. If a handful of new companies charge you drastically higher rates, saving time and staying with your existing insurance company could be better.

5. Cancellation Fees

Finally, your existing company may charge cancellation fees for ending your policy early. The best way to avoid fees is to cancel at the end of your annual renewal period. However, if you want to cancel during your term, it’s helpful to understand the two types of cancellation fees.

- Short rate: You’ll generally be required to pay three weeks worth of penalties. For example, if your annual policy was $1,200, you must pay $23.08 worth of fees for cancelling early.

- Pro-rate: If you paid upfront, your provider would refund the total amount for the months you haven’t used. For example, if you paid $1,200 and cancelled for the beginning of November, you will receive $200 back.