Compare Critical Illness Insurance

Get multiple critical illness insurance quotes in minutes

Tell us where you're located

The first step is to enter your province in the box on the left, and click on the “Compare” button. Your province will enable us to determine in which Canadian province you’re located and to redirect you to the appropriate partner.

Tell us about your health

The second step is to fill out our partner’s application, which starts by asking for health information necessary for a critical illness insurance quote, such as your sex and whether or not you smoke.

Tell us more about the amount of coverage you are looking for

The third step is to select how much life insurance coverage you want to get.

Tell us more about you

The fourth step before submitting your request is to enter your birth year and month, first and last name, and the best way to contact you.

Tips to save on your next critical illness insurance policy in Canada

Compare the coverage offered by several insurers

Critical illness insurance can cover a wide variety of conditions. That’s why you need to look at each insurer’s list and definition of covered conditions. An offer may seem attractive but offer less coverage than another company. Comparing the products offered requires finding the necessary information and reading it carefully. If you’re having trouble understanding what coverage is included in an offer, don’t hesitate to ask the insurer questions.

Pay your premium on an annual basis

In general, an insurance policy will cost you less if you avoid paying it in monthly installments. Instead, consider paying your premium annually. Some insurers may charge you up to 8% more if you choose monthly payments. For example, if you have a profile that insurers perceive as riskier and your premiums are high, saving 8% will put a few hundred dollars back in your pocket.

Have a return of premium clause included in your policy

Take a close look at your policy offer to find out under what conditions you could receive a return of premiums. Some critical illness insurance policies may offer to reimburse the premiums you paid under certain circumstances, such as if the policy ends without you making a claim. The amount reimbursed and the conditions for obtaining it depends on each insurer and are detailed at the time of purchase of the policy.

Buy your insurance while you're young and healthy

Insurers almost always reward people who get in early to buy a policy. The cost of critical illness insurance usually varies depending on your health status at the time of purchase, your age and gender. Plus, if you smoke, it will definitely work against you! To benefit from a low premium, buy your insurance policy while you are still young. Waiting as long as possible, when health problems start to appear, is not the best strategy for getting a good premium.

Get multiple critical illness insurance quotes in minutes

Learn more about critical illness insurance

Insurance

Critical Illness Insurance: How It Works and Is It for You?

Canada defines a critical illness as a life-threatening or life-altering illness or condition. Getting diagnosed with a critical illness devastates the patient and their support network. Based on data by the Government of Canada, about 1 in 12 adults live with a diagnosed heart disease. The study also predict that 1 in 2 Canadians would […]

Insurance

Group Insurance: More Than Just Financial Benefits!

In collaboration with Assure Direct The world of insurance can sometimes be difficult to grasp. There are many products available and the vocabulary is complex. As a customer, do you ever wonder if you’re paying the right price for the protection you have? Before taking out an individual insurance policy, it is essential to consider […]

Insurance

What is wage loss insurance?: An Essential Guide for Canadians

Canadian employees work hard day in and day out to support themselves and their families. Unfortunately, life can throw unexpected curveballs, such as serious illnesses, injuries, and other unforeseen circumstances, preventing individuals from earning their wages. If you can’t work, you could experience financial hardship. One of the benefits your employer may provide to protect […]

Get multiple critical illness insurance quotes in minutes

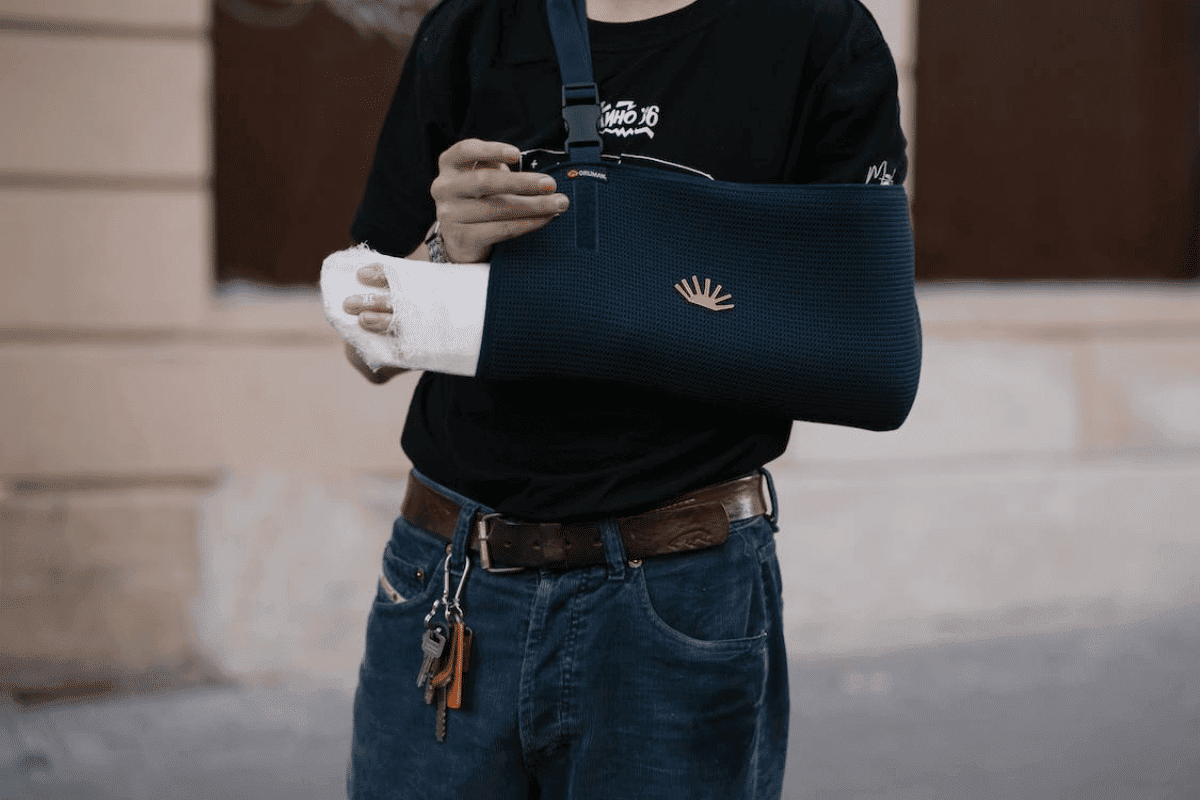

What is critical illness insurance?

In 2022, researchers estimate that there will be 233,900 new cases of cancer in Canada and 85,100 deaths from this disease. The emotional and financial impacts of cancer are well known: frequent absences from work and travel for various treatments, family upheaval, body changes, medication, and surgery. If cancer strikes you, will you be able to support yourself while continuing the treatments required to recover? Do you have an emergency fund that would allow you to afford private health care, if needed? Being bothered by financial worries is the last thing you need when you’ve just been diagnosed with a critical illness.

The implications of a serious illness

A person who becomes critically ill may need in-home help for their care, cleaning or cooking meals, a babysitter or homework help for their children, private health services, and may need to purchase adaptive equipment or try experimental treatments that are not covered by the public plan. Critical illness insurance pays a lump sum to an insured person with a critical illness that meets the policy definition for their specific condition. You can purchase an insurance policy for yourself or your loved ones, such as your spouse or children. How you use the benefit is up to you and you have the right to spend it as you wish. For example, the amount paid by critical illness insurance may allow you to retire earlier or allow a caregiver to temporarily stop working to care for you. So, with the amount your insurance pays, you are better equipped to deal with the new expense caused by your illness. It gives you the financial flexibility you need to take the time to fully recover before returning to work

A private plan complements the Canadian public plan

Like most Canadians, you may have access to public provincial health insurance. This varies from province to province and covers only certain expenses for the care that is required for your medical condition. In addition, you may want to undergo treatment abroad. Critical illness insurance is, therefore, an excellent complement to the provincial plan.

Critical illness insurance for children

Critical illness insurance is for everyone, regardless of age, gender, or health status. Although children are less likely than adults to develop a critical illness, some insurers offer coverage tailored to children. These conditions are not found in adult coverage and can include cystic fibrosis and Down syndrome. With this type of insurance, the benefit allows you, for example, to compensate for a loss of income when you have to spend time at your sick child’s bedside. If you are reluctant to purchase insurance for your child, know that you can purchase a return of premium clause. In certain circumstances, all or part of the cost of the insurance will be reimbursed to you.

Frequently asked questions about critical illness insurance

Is critical illness insurance worth it in Canada?

If you have the health and lifestyle that allows you to get an attractive premium, critical illness insurance can be a real asset, especially if you have had several critical illnesses in your family. To determine if this is the right coverage for you, compare the coverage offered, its price along with the costs you may incur to support yourself, and its coverage in your province for treatment following a critical illness.

What does critical illness insurance cover?

Is critical illness insurance taxable in Canada?

Can critical illness insurance be canceled in Canada?

Do I need critical illness insurance in Canada?

Does my life insurance policy include critical illness insurance?

How much critical illness insurance do I need?

How much does critical illness insurance cost in Canada?

Who needs critical illness insurance?

Are critical illness insurance premiums tax deductible in Canada?

Can I get critical illness insurance if I have cancer?

What illnesses are covered by critical illness insurance?

How do I make a claim for critical illness insurance?

Hardbacon users are 100% satisfied

Compare Critical Illness Insurance