TD sample cheque: everything you need to know to find it and understand it

By Julien Brault | Fact-checked by Lois Tuffin | Published on 02 Mar 2022

From pre-authorizing payments to getting paid, sample cheques still come in handy, even though Canadian use cheques far less than they used to. Periodically, you may need a TD Canada Trust sample cheque to share your banking information with someone else.

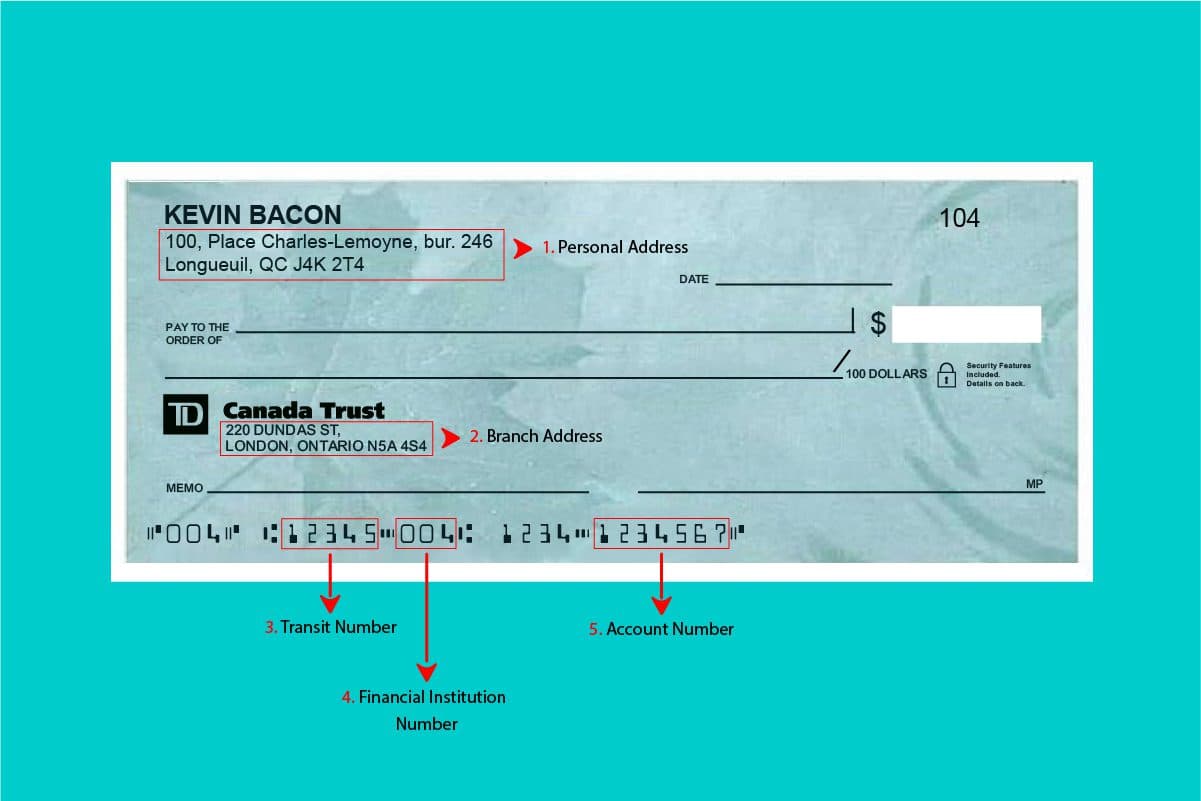

Understanding Your TD Sample Cheque

If you know what the numbers at the bottom of your TD sample cheque mean? You can probably just share those numbers without having to go looking for a sample cheque in your banking portal every time someone asks for one. For instance, your employer may need one to set you up on a payroll system.

So, here are the important features of a cheque in Canada that you can gauge with a quick look:

1. Your home address

Obviously, you don’t need to look at a sample cheque to know this information . However, those who ask you for a sample cheque will find it handy to have alongside the other details.

2. Your bank branch address

This is the address of your bank branch since TD branches offers more than one point of service.

3. The Transit Number

This five-digit number identifies the TD branch associated with your bank account.

4. The Institution Number

This three-digit number points to the financial institution you deal with, regardless of the branch you have chosen. TD’s institution number is 004.

5. Your account number (or folio number)

The account (or folio) number pinpoints your specific bank account. Without the transit number and institution number, it cannot be used to transfer money. As a result, it remains the most sensitive information relating to accessing your finances. This number varies in length depending on the financial institution, but TD account numbers always include seven digits long.

How to find your sample cheque on the TD online portal

Before the Internet, a sample cheque came out on paper with “SAMPLE” or “VOID” written on it to ensure no one would use it. If you have a chequebook, you can still do this. Despite a trend toward digital payments, Canadians still write and pay via cheques more than a billion cheques each year. In fact, a sample cheque documents all the information listed above, so you can still do it that way.

For those who don’t want to waste paper, or who simply don’t have a chequebook, you can still obtain a TD sample cheque equivalent by logging into the TD online portal. The “Direct Deposit/Pre-Authorized Debit payment form” contains all the same information asa sample cheque. Here are the steps to download this document with just a few clicks:

- Log into your TD account through the EasyWeb portal using the following link: https://easyweb.td.com/waw/exp/

- Click on the account for which you would like a sample cheque.

- Click on “Direct deposit form (PDF)” on the right side of the page.

- A PDF document containing your banking information should open in your browser; all you need to do is download it.

Now you know everything you need to know about finding your TD sample cheque and interpret the different elements on it!